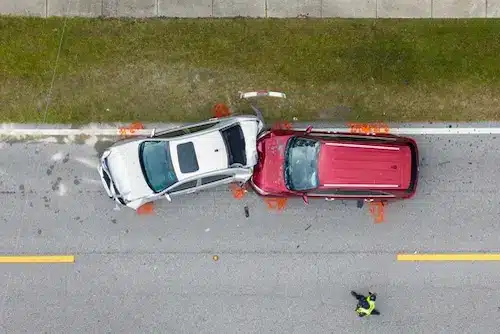

What Happens If Someone Else Is Driving My Car & Gets Into A Car Accident?

What Happens If Someone Else Is Driving My Car & Gets Into A Car Accident?

Understanding what happens if someone else is driving your car and gets in an accident is crucial for any car owner and car insurance coverage. Navigating the complexities of car insurance and liability can be challenging, especially when it involves another person driving your car.

The Basics of Car Insurance Coverage in Beaumont, TX

Car insurance in Texas is designed to protect you, your vehicle, and others on the road in case of an accident. Typically, your auto insurance policy includes several types of coverage:

- Liability coverage: This pays for the other driver’s injuries and vehicle repairs if you are at fault.

- Collision coverage: This pays for your car’s damage after a collision.

- Comprehensive coverage: This covers non-collision incidents like theft, vandalism, or natural disasters.

- Medical payments coverage: This pays for medical bills for you and the medical bills for your passengers.

- Uninsured/underinsured motorist coverage: This covers you if the at fault driver has no insurance or insufficient coverage.

What Happens If Someone Else Is Driving Your Car?

If someone else borrows your car and is involved in an accident, your car insurance policy is typically the primary coverage. This means that your insurance company will initially handle the claim, regardless of who was driving your car. However, there are several factors to consider:

- Permission to Drive: If the person driving your car had your permission, your car insurance should cover the damages. This is known as “permissive use.”

- Exclusions in Your Policy: Some auto insurance policies exclude certain drivers. For instance, if the driver is excluded from your policy or not licensed, your insurance might not cover the accident.

- Driver’s Insurance: If the driver involved in the accident has their own insurance, their policy might offer secondary coverage, which can help pay for damages or injuries exceeding your policy limits.

Liability and Coverage Details

In Texas, the car owner’s auto insurance carrier is generally responsible for covering the damages when someone else is driving your car and gets in a car accident. Here are the types of car insurance policies that come into play:

- Liability Insurance: This is the primary insurance that will pay for the other party’s property damage and bodily injury. Texas requires minimum liability coverage, but higher limits are often recommended for better protection.

- Collision Coverage: If the car accident causes damage to your vehicle, collision coverage under your auto insurance policy will cover the repair costs, minus your deductible.

- Medical Payments Coverage: If there are medical expenses due to the accident, this coverage can help pay for them. It covers the driver and any passengers in your car.

What If the Driver is at Fault?

If the driver of your car is at fault in the car accident, your liability insurance will cover the other party’s damages and injuries up to the policy limits. If the damages exceed your policy limits, the at fault driver’s insurance might come into play for additional coverage.

Steps to Take After an Accident

If someone else is driving your car and gets in an accident, follow these steps:

- Ensure Safety: First, ensure everyone involved is safe. Call emergency services if there are injuries.

- Exchange Information: Collect information from all parties involved, including driver’s license numbers, insurance details, and contact information.

- Document the Scene: Take photos of the accident scene, vehicle damage, and any injuries.

- Notify Your Insurance Provider: Report the accident to your insurance company as soon as possible. Provide all necessary details and cooperate with their investigation.

- Consult an Attorney: If there are significant damages or injuries, or if liability is disputed, seek legal counsel to protect your interests.

Potential Complications

Several complications can arise if someone else is driving your car and is involved in an accident:

- Unlicensed Driver: If an unlicensed driver was operating your vehicle, your insurance might deny the claim, leaving you personally responsible for damages.

- Negligent Entrustment: If you knowingly allowed an unsafe or unlicensed driver to drive your car, you might be held legally liable for any damages caused.

- Excluded Drivers: If the driver is specifically excluded from your policy, your insurance will not cover the accident.

Insurance Implications

A car accident involving another person driving your car can impact your insurance premiums. If your insurance pays out a claim, you may see an increase in your rates as the car owner. It’s essential to understand how your insurance provider handles such claims and to review your insurance coverage details.

Consult Brent Coon & Associates Today!

When an individual other than yourself is driving your car and is involved in an accident, understanding your car insurance coverage and responsibilities is crucial. In Beaumont, TX, your own insurance company typically provides primary insurance coverage, but various factors can affect how claims are handled. By knowing the types of coverage available, the role of the at fault driver, and the steps to take after an accident occurred, you can better navigate this challenging situation as a vehicle owner.

If you find yourself in this predicament contact the experienced legal counsel at Brent Coon & Associates, can provide valuable guidance, help protect your rights, and seek compensation. Remember to always review your auto insurance policy and discuss any concerns with your insurance provider to ensure you have adequate coverage for all possible scenarios especially with another person driving your car.

search

our offices

FROM THE BLOG

Texas A&M donors’ lawsuit against 12th Man Foundation over Kyle Field seats and parking to proceed

By David Barron, Correspondent A Brazos County state district judge has cleared the way for a long-delayed trial showdown between a group of disillusioned Texas A&M donors and the A&M-affiliated 12th Man Foundation, stemming from a decade-old dispute over seating and parking rights at Kyle Field. State District Judge George Jerrell Wise on Wednesday signed an order denying a summary…

Lawsuit Against Texas A&M Aggies 12th Man Foundation Moves Forward

A legal showdown between former Texas A&M donors and the 12th Man Foundation will proceed at last. A Brazos County judge has ruled that a lawsuit between former Texas A&M Aggies donors and the 12th Man Foundation will move forward, David Barron of the Houston Chronicle reports. On Wednesday, State District Judge George Jerrell Wise…

Texas A&M donors’ lawsuit against 12th Man Foundation over seating, parking dispute cleared for trial

A group of Texas A&M donors will finally get their day in court for a dispute against the 12th Man Foundation over parking and seating at Kyle Field. According to the Houston Chronicle, a judge in Brazos County last week denied a summary judgment motion from the 12th Man Foundation, which sought to dismiss the…